- 24 August 2021

- alternative asset class|alternative investing|portfolio diversification|sme lending

Validus: Collections and default management

In an earlier Q&A, “Managing Risks in SME Lending,” Milena, our Head of Investor Relations and Corporate Development addresses some of the most commonly asked questions about the risks associated with SME lending.

This article delves further into collections and default management processes; and what you need to know about how Validus safeguards your interests on the platform.

Understanding the collections process at Validus

Validus has a dedicated in-house Collections team, who has adopted and enhanced a robust collections process over time, employing a tailored approach unique to each case and driven by our team’s strong experience in managing risk in the SME debt investment space.

Careful management of repayments is both automated on the one hand, with curated human intervention enabled by tech-driven monitoring tools. Our team continuously adjusts repayment plans in line with the SME’s real-time data on financial status and stability levels.

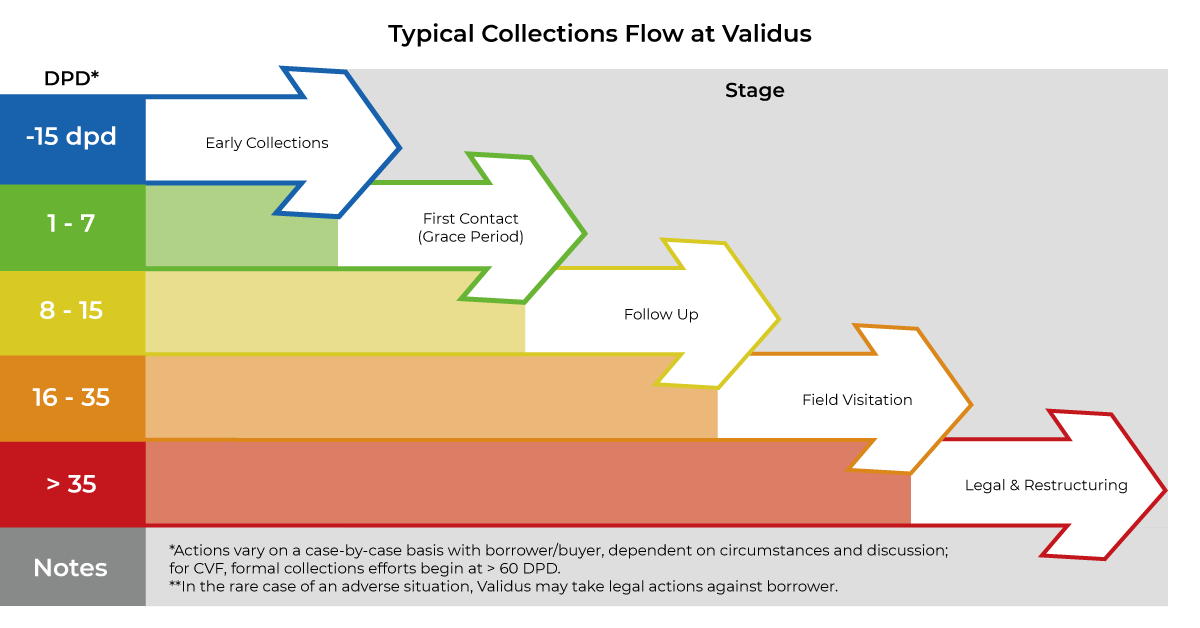

We follow a standard collections process at Validus, adhering to strict timelines under which we immediately pursue action if proper repayment is not received:

Defaults VS Delayed Repayment

Under the MAS’ definition of default, any loan past 90 days due is considered a default. It is crucial to read into the fine print how a lending platform reports these numbers, as the size and magnitude can vary based on the metrics they are citing. Taking non-performing loans as a percentage of total loans disbursed over the platform’s lifetime will significantly minimize the impact of the non-performing loan rate (expressed as a percentage) reported. Suppose you were to look at this on a cohort basis (non-performing loan rate of loans disbursed in the last 12 months as MAS defines default rate) or outstanding book. In this case, that number might have been much more significant than the other methodology reflected.

Good to know: When selecting a platform to lend through, we advise investors to ensure that default rates presented are not masking actual numbers or displaying them in an opaque manner. When in doubt, ask a relationship manager (RM).

It is also important to note that at the same time, delayed repayment is not always equivalent to a loss of funds. In many cases, SMEs face a mismatch in payment timings for work they have delivered. Hence, SME financing platforms like Validus exist to cater to this asset class, driven by steady demand, and help close the cash flow gap with supply chain financing solutions.

Pro-tip: Remember to check that the platform you are lending through is transparent in its communications around any delays.

We always encourage our investors to reach out to their relationship managers for any questions. Bi-weekly updates on the platform are also readily available.

Safeguarding your interests on the platform

Defaults are no stranger to even the most established financial institutions because there are no foolproof investment guarantees. Every investment available in the market carries a certain amount of risk, and the degree of risk will change depending on the type of risk you undertake.

On the flip side, it is possible to minimise the risk of default, and Validus employs a series of risk mitigation strategies to safeguard your interests on the platform.

Learn more about how Validus makes investing in SME lending attractive and the various investment products to diversify your portfolio with this low-volatility investment; our IR team is just an email away: [email protected].

You can get real-time updates on your current investments and future opportunities via the Investor mobile app for current Validus investors. Download via App Store or Google Play today.

Share this Article: