Peer-to-peer (P2P) lending—or the practice of lending money to individuals or businesses through online services that match lenders with borrowers—is an increasingly popular asset class. As far back as 2013, studies from the University of California, Berkeley noted that P2P loans “remain durable throughout economic cycles, and can provide a significant boost to portfolio income.”

In particular, P2P loans are of interest to accredited investors in the current economic climate. They are not correlated to conventional stock and bond markets, and their performance has not been as adversely affected by recent oil- and COVID-19-related stock market plunges.

Wealth managers and investors across the world acknowledge that P2P loans bear the unique characteristics of short loan tenures, high returns, and low default rates. In Singapore, the majority of P2P lenders have a default rate of zero to less than 2%.

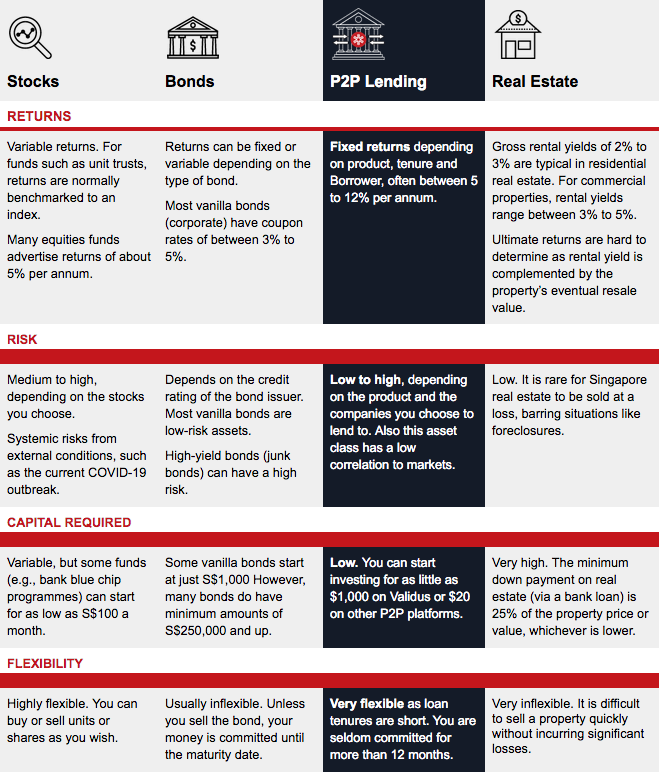

But how do these P2P lending compare to other popular investment options in Singapore?

The key differentiators of P2P lending from other investment instruments

Some of the key traits of P2P investments, which you may not find in other asset classes are:

- Very short loan tenures

- No correlation to conventional stock and bond markets

- Absolute returns

- Comparatively high returns

- Low initial cash outlay

- Streamlined for accredited investors

1. Very short loan tenures

P2P or SME lending platforms don’t often provide long-term loans. In most cases, loan tenures range between three to 12 months. As such, you won’t have your capital tied down for long periods.

This also minimises opportunity costs—you’re more likely to have your cash back in hand when the next opportunity comes along.

In contrast, bonds need to be held to maturity before you receive the final payout. (You could sell the bond, but also incur a loss.) Equities tend to be angled at long-term capital gain; unless you’re a trader, investments like Exchange Traded Funds (ETFs) or unit trusts are often meant to be held for 10 to 15 years. Liquidating them before that is possible, but that might also mean lower gains or losses on your end.

Real estate is rarely a short-term commitment. Do note that Singapore imposes a Seller’s Stamp Duty* on homes sold within the first three years of purchase.

For the most part, property can take decades to accumulate rental income and appreciate in value. Purchasing a second property also incurs additional stamp duties of up to 12% (higher for non-citizens), which means waiting even longer to break even on resale.

*12% of the sale price if sold in the first year, 8% in the second year, and 4% in the third year.

2. No correlation to conventional stock and bond markets

P2P lending assets do not move in tandem with the conventional stock and bond markets. Unlike equities, for example, you won’t suddenly see a sudden drop in value or payouts due to viral outbreaks, weak economic data, etc.

As such, it can make sense to diversify and have P2P lending make up a portion of your portfolio that has no correlation to stocks or bonds.

3. Absolute returns

P2P lending is a debt instrument and the borrower must make repayments as agreed in the loan terms. As an accredited investor, you get a fixed and consistent amount—similar to fixed income securities like vanilla bonds.

Unlike equities, your returns do not change based on how well the company is performing (i.e., unpredictable dividend payouts), nor is it pegged to a fluctuating benchmark like many unit trusts.

4. Comparatively high returns

P2P lending can provide high returns compared to products with similar traits. For example, most money market instruments—which deal in short-term loans—provide annualised returns of 2% to 3%. P2P lending can provide 5% to 12%.

Investments that deliver fixed returns, such as bonds, also do not typically pay out such high returns. Most corporate bonds pay out between 3% to 5% per annum. Singapore Savings Bonds (SSBs) pay out between 2% to 3% per annum, and that’s only if they are held to maturity for 10 years.

5. Low initial cash outlay

With P2P lending platforms such as Validus Capital, you can begin investing with as little as S$1,000 a month.

This is not possible for many bonds. While some vanilla bonds today are more accessible, many others require minimum sums of as high as S$250,000.

The initial cash outlay is also much lower than, say, real estate assets. The minimum down payment on residential real estate (via a bank loan) is 25%. Private property priced at S$1 million—considered the lower end of the scale in Singapore—would already require a minimum down payment of S$250,000.

6. Streamlined for accredited investors

P2P lending is a passive asset that require little explanation. Here, you choose which companies to lend to on the P2P lending platform, and the companies pay you back with interest. These are just three to 12-month short-term loans and do not involve complicated processes such as revenue-based financing or collateralisation.

Many investors will find this better to work with than the inner workings of a fund; or the complexities of deep discount bonds, perpetual bonds, and step-down bonds.

While real estate is also considered a simple investment, it is rarely as passive as P2P lending. Unless a property manager is hired, the investor usually needs to take an active hand as a landlord.

Are you investing on a reliable, licensed P2P platform?

P2P platforms like Validus Capital are regulated by the Monetary Authority of Singapore (MAS). It offers lending opportunities only to accredited investors (HNWIs and institutional investors), and offers insurance schemes for capital protection on most of its facilities in the event of a default.

Borrowers on the platform are screened and vetted, and any funds from investors are held in escrow; they never go directly to Validus’ own account.

With the growth of P2P platforms in the region, it’s time for wealth managers—as well as accredited investors themselves—to evaluate the role this new asset class can play in their portfolio.

In general, SME direct lending is an alternative asset class that can play its part in a well-balanced portfolio, offsetting the low returns of more defensive assets.

Please note that the information provided here is intended only as a general overview and should not be construed as investment advice. Readers are strongly advised to exercise due diligence or contact us [email protected] for any further enquiries. The information and opinions contained in this article has been obtained from sources believed to be reliable, but Validus Capital makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Opinions and estimates are subject to change without notice. Reference to any third party information (including information provided by a third party or accessible through any linked site), product, process, or services at this website or any linked site is not an express or implied endorsement by Validus Capital of the same.The article has not been reviewed by the Monetary Authority of Singapore, or any regulatory authority elsewhere.