In a matter of a few months, COVID-19 has wreaked havoc across the state of the world’s political, social, and economic climate.

Oil prices are plummeting, local currencies are devalued, and travel bans, community quarantines, and other government restrictions have had a severe impact on trade, tourism, and capital flows.

Some analysts believe that this may be the deepest global recession in history, inflicting damage surpassing even that which was brought about by previous such crises. In the span of just a few months, an 11-year bull market has taken a free-fall. The stock market index of the 30 largest companies in the US—otherwise known as the Dow Jones Industrial Average—dropped by 20% in just 20 trading days, making it the “fastest bear-market plunge in history.”

The indefinite timeline with which these self-isolation strategies will be implemented and the wholly unpredictable nature of this situation can mean highly volatile markets. The Cboe Volatility Index (VIX), or “Fear Index,” is also hitting record-highs with a score of 82.69 in March 2020, surpassing even the peak level of 80.74 in November 2008—the VIX during the 2008 financial crisis.

How should investors react to these macroeconomic changes?

“Don’t panic”

Individuals feel losses twice as strongly as gains. As investors and high net worth individuals (HNWIs) witness their investment values plummet, a knee-jerk reaction would be to seek liquidity by holding cash. However, taking a balanced approach towards investing and seeking instruments that net positive returns through in-built loss-mitigation features is one strategy investors have employed.

Jason Hollands, managing director at London-based investment firm Tilney, shares his company’s investment strategies during this time: (1) invest in “resilient” firms, or those that have been seeing increasing numbers based on changing consumer behavior, such as online groceries and video conferencing platforms; and (2) invest in “ugly duckling companies”—those that are massively impacted by the virus but have strong enough balance sheets to withstand the downturn.

Blue-chip equities such as Disney, Coca Cola, and General Motors are also opportune investments. Market volatility has pulled the prices of these down, giving investors the chance to capitalise on these assets at a good price considering the likelihood of their recovery. According to financial journalist Jeremy Bowman, Walt Disney stocks plummeted 20% in March from the company’s all-time high in November 2019, stating that Disney stock “may never be this low again.”

When selecting investments, it is crucial to remember that past performance is not indicative of future results—COVID-19’s effect on the economy is significantly different from past economic crises. Instead, it’s a company’s ability to withstand economic downturns that will dictate investability.

Investors are now looking at companies that have higher free cash flows to sales, sufficient reserves, minimal debt, and the like. Even private equity fund managers that have prioritised high growth potential in the past are now prioritising stability foremost, looking towards sectors with high safety margins and growth opportunities.

As alarming as this situation seems from an economic standpoint, experts assure us that bear markets are part of the natural cycle of the economy, pointing out that Warren Buffet is one of the wealthiest investors in the world and he consistently capitalised on these periods of decline.

Hollands says, “Coronavirus is undoubtedly a major economic shock, with significant short term ramifications for markets, but this period will ultimately be transitory, and it is vital clients participate in the recovery phase and don’t bail out at the point of maximum stress. We are therefore reminding clients to hold their nerves and to keep investing.”

Diversification is key

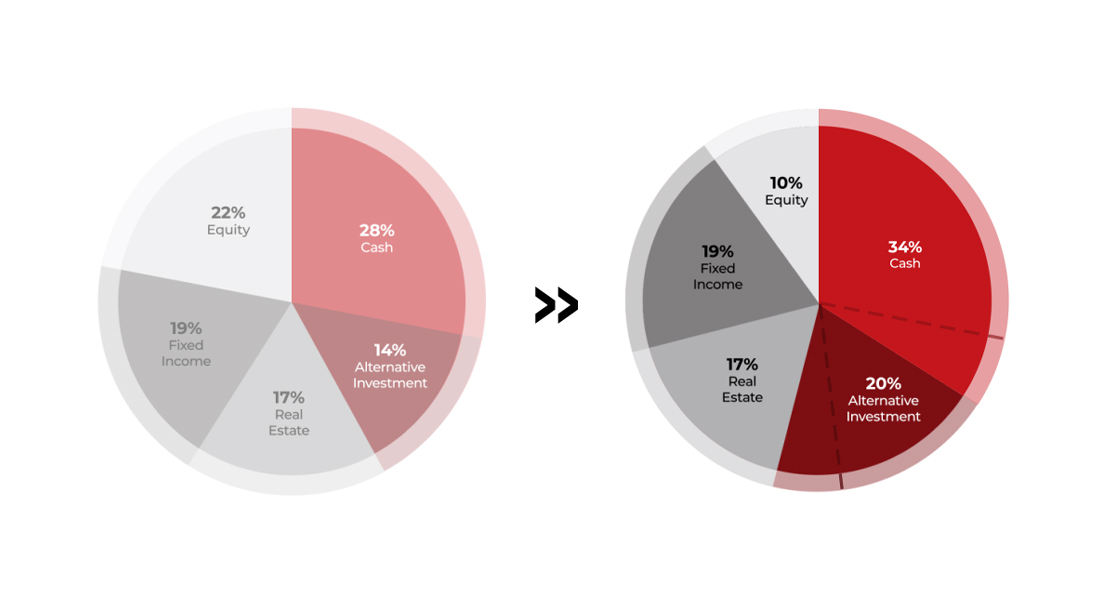

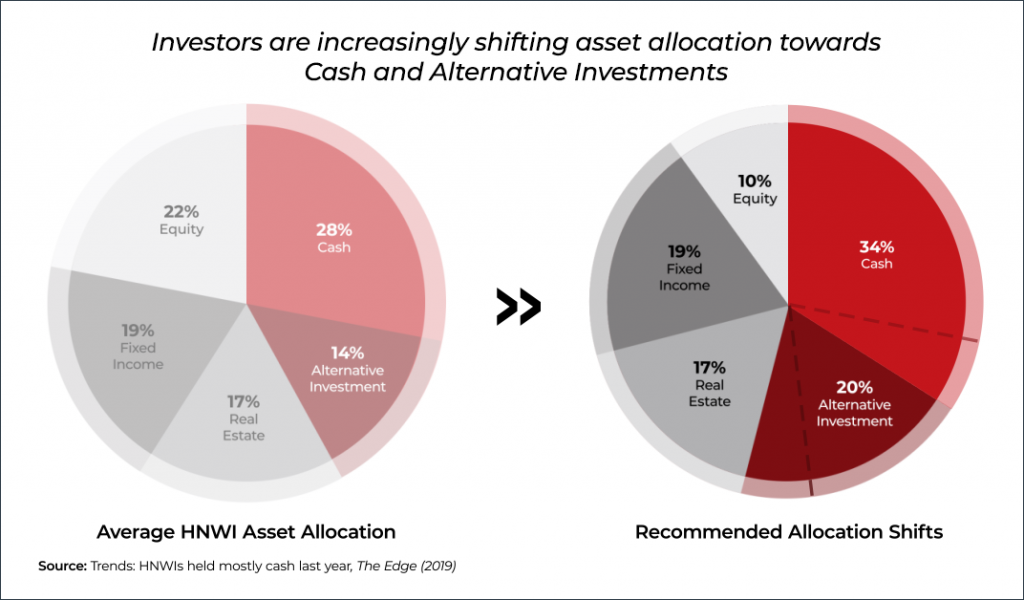

Diversification is also becoming a prominent strategy among investors and HNWIs in light of COVID-19. A diversified portfolio can minimise the risk of loss, provide stable returns, and offer resilience during economic downturns. While it’s impossible to predict how assets will perform under any given scenario, putting your eggs in several baskets will allow you to take a risk-adjusted approach, balancing returns with potential losses.

This was what many HNWIs had in mind when they invested at least one-fifth of their wealth into alternative assets such as private equity, hedge funds, and P2P lending in 2018. This move was a means of enhancing returns and cushioning losses by reducing correlation within portfolios.

To put diversification strategies to the test, online publication International Investment conducted a poll that involved 260 investors across 28 countries, with a total asset assessment of over US$2.5 trillion. The goal was to measure their satisfaction with their diversification strategies. The types of alternative assets they invested in varied, but three in five stated they were satisfied with their diversification strategies, as well as with the performance of their illiquid strategies.

COVID-19 has prompted 11% of investors to make “significant dynamic or tactical changes” to their portfolios, and many are also in the process of rebalancing their portfolios to mitigate further risk. However, 27% of those planning to rebalance their asset allocations said that they found the whole process challenging as liquidity risk and downside risk are primary concerns.

Allianz Global Investors’ Manuela Thies agrees that diversification is not an exact science, and not all diversification strategies work to a tee. She does, however, advocate that it should be a permanent objective to mitigate risk. Especially during this time of crisis, active asset allocation is necessary for individuals to remain on top of their investments.

Alternate investments and P2P lending

One alternative asset class that has been gaining traction in the past few years is Small and Medium Enterprise (SME) direct lending via peer-to-peer (P2P) platforms.

P2P loans are a relatively new type of investment where investors can lend money to borrowers—usually individuals or SMEs—through a P2P lending platform. This provides a new avenue for borrowers to obtain credit, and at a much faster rate than they might receive from a bank or a grant.

P2P loans have very short loan tenures, low initial cash outlay and default rates, and comparatively high returns. Typical financial assets that deal in short-term loans, such as money market instruments, can provide annualised returns of 2% to 3%, whereas P2P lending can provide 7% to 12%. And as these investments are essentially debts, investors can expect repayments as agreed on the loan terms.

But one of the most appealing parts of P2P lending, especially during this period of uncertainty, is that it has no correlation to stock and bond markets, and therefore can perform consistently even amidst the pandemic.

Rajat Gandhi of P2P comparison platform 4th Way says that investments in P2P lending “continue to hold ground” even as investments across most asset classes have taken a hit.

Still, portfolio companies remain vigilant in assessing the impact of COVID-19 on their loan portfolios and are taking on the necessary measures to mitigate risk. Singapore’s P2P marketplace Validus, for example, is successfully managing its portfolio to mitigate COVID-19’s impact.

Nikhilesh Goel of P2P lending platform Validus says, “In maintaining our portfolio performance, we continue to focus on key opportunities in Corporate Vendor Financing (CVF) and Invoice Financing products across sectors. Our current portfolio has minimal concentration within sectors that are directly impacted by COVID-19, and where present, we have built-in safeguards by being linked to B2B scenarios and government entities for whom our borrowers are providing essential services to.”

In addition to tightening credit policies for SMEs in sectors heavily impacted by COVID-19, Validus Capital has been restructuring terms where required in order to accommodate long repayments in consideration of prolonged cash flows.

The P2P platform reported a spike in demand for unsecured loans due to COVID-19. Validus Capital registered a 50% to 75% jump in applications last March 2020.

Opportunities to finance SMEs arise

Not to be seen as just an opportunity for investors to yield better returns, it is also a chance to inject more cash flow into the economy—especially in a time when it direly needs it.

In Singapore, SMEs are key drivers of the economy, making up 99% of the country’s enterprise and contributing to 65% of employment and close to $200 billion to the economy. SMEs are also among those most severely impacted by the pandemic. Unlike corporations and startups flush with VC investments, SMEs don’t have the cashflow to endure extended periods of decreased revenue.

Both government and local banks are providing SMEs with financial aid to help them manage their immediate cashflow needs during the COVID-19 pandemic. DBS and UOB stated they saw a significant rise in SME loan applications.

With banks and the government pulling all the stops, these institutions have to deal with the volume of demand and risk associated with providing much-needed financial support, severely stretching their capacities. For those who are willing to contribute, P2P Financing serves as an alternative channel to support SMEs during this time.

In 2018, a study conducted by Steward Redqueen reported that Validus Capital supported over 10,000 jobs in Singapore. The SMEs that received financing through the platform reportedly contributed over S$400 million in GDP that year. These SMEs also experienced a 17% increase in annual revenue and a 12% increase in employment growth.

Historically, Singapore SMEs found it difficult to receive financial support from traditional loan and investment channels as they often did not qualify for business financing, mostly because of a lack of credit and collateral track records. But through P2P investments, they were able to realize their business objectives and achieve a sharp growth in sales.

Now, more than ever, reputable SMEs are seeking financial aid and short-term financing. These investments can ensure that SMEs are well-equipped to tide through the economic downturn and accelerate growth after the COVID-19 crisis.

Remaining resilient

It goes without saying that this pandemic has incited high market volatility, uncertain economic conditions, and a steep decline in equity markets. Redistributing asset allocations is one option that investors have to remain resilient, mitigate risk, and support the economy during these uncertain times.

An investor on the Validus platform shares, “Validus has provided a unique platform for SME lending and hence the allocation to this asset class in our portfolio is likely to increase. Validus’s sourcing ability and quality checks makes it a very attractive investment opportunity. Under the current Covid-19 situation when asset values across classes are eroding, an investment in SME lending is a sensible part of a balanced portfolio.”

Note: Article has been adapted for and published on Wealthup.