News & Insights

- 3 November 2020

- accountants|fintech|fintech sg|revolution|sgsmes|SME financing

Accountants & Fintech Revolution: Taking Advantage

- 30 October 2020

- accountants|Covid-19|fintech|fintechsg|P2P Lending|sgsmes|small business loans|SME financing

An accountant’s guide to P2P lending

- 23 October 2020

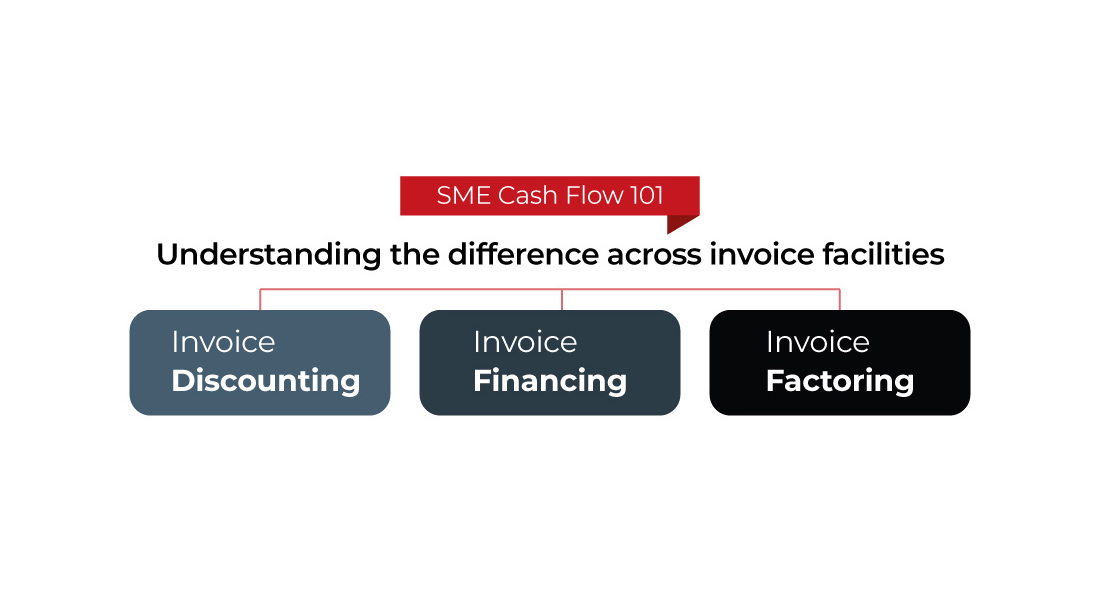

- invoice discounting|invoice factoring|invoice financing|small business loans|SME financing

Invoice Financing: Factoring, Discounting Explained | Validus

- 13 October 2020

- accredited investors|alternative investing|HNWIs|p2p investing|P2P Lending accredited investors|investment portfolio|portfolio diversification|SME credit|sme lending

P2P Lending As An Alternative Investment – Should Singaporean Investors Get Into It? | Validus

- 8 October 2020

- enterprise financing scheme|enterprise singapore|growth financing|pfi|sgsmes|small businesses|SME financing

Validus First Fintech Approved by Enterprise Singapore as PFI

- 6 October 2020

- Covid-19|Financial Inclusion|fintech|SME financing|sme lending

Fintech lending platforms bridge Vietnam’s SME funding gap

- 2 October 2020

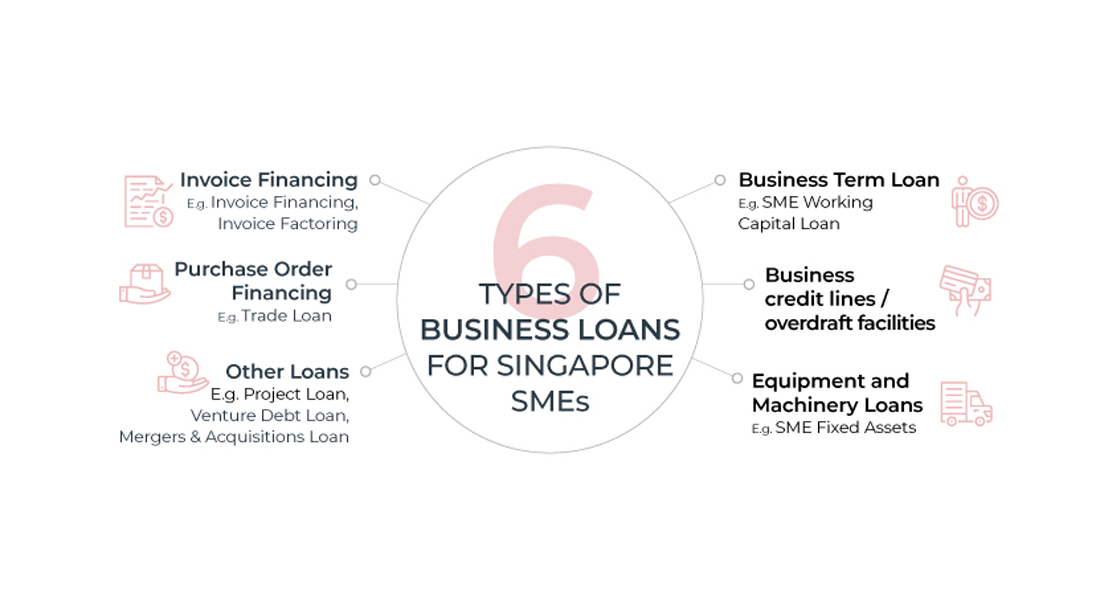

- business financing|business loans|sgsmes|Singapore SMEs|working capital

Types of Business Loans for SMEs

Download our exclusive SME Financing Economic Impact Study

We’re proud to share the findings of an independent study by Steward Redqueen, on the economic impact of Validus’ business financing activity in Singapore. By empowering SMEs through accessible financing, there was a considerable impact in GDP creation, and job growth across these SMEs in Singapore.

Through this report, we hope to highlight the financing challenges SMEs currently face, drive greater awareness on alternative credit sources available to help fuel SME growth and foster ecosystem collaboration.